In 2023, as interest rates are increasing all over Canada one wants to get the cheapest rates possible for their mortgages. As inflation is rising, property prices have grown by more than 38% in comparison to last year.

Paying High-Interest rates on a home loan can be one of the biggest financial mistakes that a first-time home buyer can make because home loans have longer span of repayment periods so compunding of interest and principal happens often So, even the smallest difference in the interest rates could cost thousands of dollars of extra payment to the buyer.

For example:

If Person A takes a loan of 500,000.00 dollars at a 5% Rate of interest per annum at the end of the tenure of 25 years he would have paid $500,000.00 in principal, $372,407.48 in interest, for a total of $872,407.48.

If Person B takes a loan of 500,000.00 dollars at a 4.75% Rate of interest per annum at the end of the tenure of 25 years he would have paid $500,000.00 in principal, $351,183.38

in interest, for a total of $851,183.38.

As a result with only the difference of 0.25% Person A will be paying $21,224 at the end of 25 years

Hence in this blog, we will discuss 5 top tips that a first-time home buyer can practice and save thousands of dollars.

What are mortgage Interest rates?

The interest rate applied to a mortgage is known as a mortgage rate. Lenders set mortgage rates, which can be either fixed (remaining the same throughout the mortgage) or variable (varying by a benchmark interest rate).

Mortage Interest rates are not as easy as they seem mortgage rates are dependent highly on bonds and stock markets and they fluctuate daily and even throughout the day.

Every individual has a different rate of interest depending upon these 8 factors.

So how to ensure that as a first-time home buyer, you can get the best rate possible in the changing marketing?

Here are the 5 advice to get the lowest interest rate first a home buyer

1. Maintain and Improve your Credit Score

Did you know credit score is one of the most important things while taking the loan? Not only it help in getting the most affordable interest rates but it will also help in getting the most loan options.

How to improve your credit score??

Did you know the amount of credit available on your credit card can affect your interest rate on future loans? This is called your credit utilization. As a general rule, you should use less than 25% of your available credit to improve your credit score. Over time, improving your credit score will give you access to lower interest rates.

For example, if your credit limit is $1,000, try to keep your balance at $750 or below. This can be difficult to maintain when it comes to purchasing high-ticket items as a first-time home buyer like a washing machine or mattress on your credit card, but you’ll get there if you pay off as much of your balance as you can each month.

Tips to lower credit utilization

1. Track your credit reports.

Every transaction done on a credit card is minutely observed by the credit card agency the payment cycle, spending intervals, what kind of purchases you made, and how often you spend money on groceries, restaurants, and luxury products. Every thing is tracked So even if you’re paying off your balance in full each month, your credit score can still be affected by your credit utilization at the time it gets reported. You can improve your credit score by determining when your balance is reported to credit bureaus and paying down as much as you can by that date, even when a payment isn’t due.

2. Turn on your notification to keep track of your balance.

By configuring a balance alert message that can be delivered to your phone or email, you can keep track of your 75% credit utilization. Setting the alarm to sound when you’ve used 70% of your credit limit is advised. You will have more time to act as a result.

3. Make consistent payments

A quick and simple strategy to reduce your debt on your card is to make more frequent payments. To help you pay off your credit card debt more quickly, try setting up automated payments with your bank every two weeks.

2. Limit credit inquiries

As a first-time home buyer, it is obvious that one will be inquiring with different lenders for the best possible mortgage rates but too many credit queries can hurt your credit score. The reason? Lenders may interpret this as “credit-seeking behavior.” You may be shopping around at different lenders for the best interest rate, but this can be counterproductive.

3. Show lenders you can proactively manage your debt

Try to be as punctual as possible with regard to loan payments and credit card payments.

-If you can afford try to pay an extra 10$ 10 on every payment that will make the lenders see that you are actively managing your debt.

-Choose the best payment frequency that suits your income cycle. There’s no “right” or “wrong” payment frequency, all that matters is what works for you.

4. Be ready for the correct market timings

If you are a first-time home buyer try to invest as much as you can in the best possible investment vehicle which gives you the best rate of returns that beats the inflation rate.Because when buying your first home timing is the most important thing. So understand your finances set up an affordability in mind and prepare yourself with the downpayments.

If you want to calculate your monthly installment for your perfect home click on the link below.

5. Choose a Secured Loan

A good credit score can provide you access to cheaper interest rates, but it’s not the only method to make your loan’s interest payments less expensive. Additionally, selecting a credit instrument like a secured loan can provide you access to lower rates.

What is a secured loan?

The value of your home serves as collateral for a secured loan. Securing your loan with your home gives the lender an additional measure of security since, if you default on the loan, the lender may take possession of the home. This additional security gives your lender more assurance that you’ll make payments and lowers the interest rate they charge you because there is less chance they won’t be repaid.

Bonus Tip

Educate yourself with financial and housing market knowledge.

Even when the cost of borrowing seems high, you can make small changes that will improve your credit score and help you access a lower interest rate. Improving your credit score won’t happen overnight, but small changes will add up over time. The best thing you can do is to educate yourself about what affects your credit and interest rate.

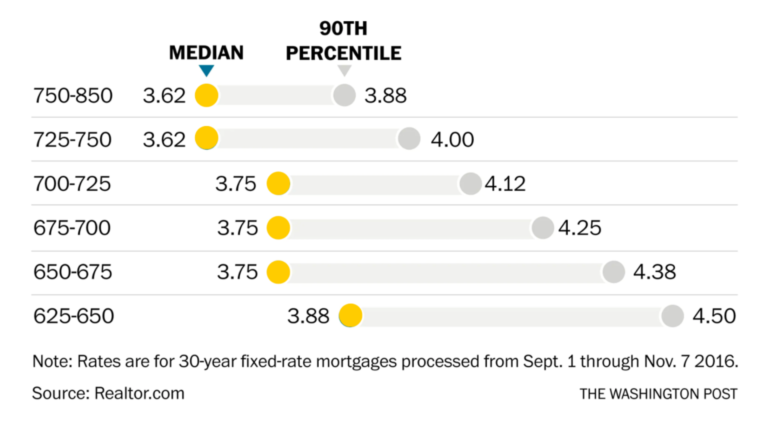

You can see in the chart shown below how an increase of 25 points in the credit score can decrease the interest rate up to 0.13%

If you don’t want to miss out on any opportunity coming. Please call +1(647) 660-0600 and register yourself as a member of teamjagghuman for all updates and notifications relating to housing and financial markets